With online sales becoming the main form of profit when it comes to many forms of merchandise, the idea of going to a store has become less mainstream. This is especially true now given the circumstances of the world.

GameStop has been one of these struggling establishments, since most people buy their games digitally. While people do still buy physical copies of games, generally they order them online rather than going to a store like GameStop.

Despite this decline, GameStop made headlines only a few weeks ago. GameStop’s stock increased rather significantly and gained hundreds of dollars in value.

The stock value for GameStop had been so low because of short sellers, investors who borrow stock from other people and sell them with the intention of buying them back later for a profit. Short selling with the intent of lowering a company’s stock value is common, but not to the degree that GameStop has gone through. GameStop’s short selling was so bad that the company was starting to lose value.

The surge in the stock’s value began when members of the subreddit r/WallStreetBets noticed that GameStop was in a “negative float” position. This means that the number of shares that must be returned was greater than the number of shares available to trade. Members of the subreddit encouraged as many people as possible to buy GameStop stock in order to get back at the short sellers. If all the stocks were bought up, short sellers wouldn’t be able to trade with their collaborators and near bankruptcy.

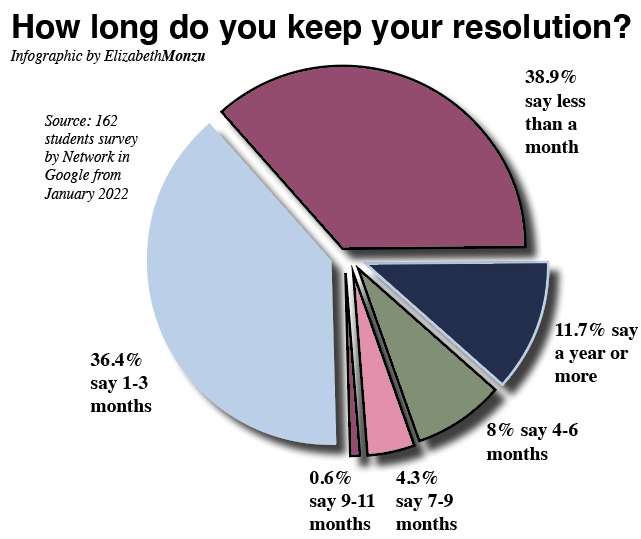

This surge in stock purchases made GameStop’s share price go over $340. The share price has gone down considerably since the initial surge, currently sitting at roughly $40 at the time of writing this article. This is still better than it was about a year ago, where the share price sat in the single digits.

Even though this situation has calmed down, the aftermath of it may have consequences for not just individuals, but the stock market as a whole. The US Justice Department has gotten involved in the situation, and are investigating as to whether there was any market manipulation. The Department has to find evidence that proves specific individuals gathered together to artificially inflate the stock.

While the Department hasn’t gone after anyone yet, investors have. Keith Gill, one of the key figures in the subreddit who drove up the GameStop share price, is being sued in federal court by Washington State investor, Christian Iovin. The lawsuit filed against Gill says that he was illegally manipulating GameStop’s share price by encouraging his YouTube and Reddit audience to purchase GameStop shares, causing a “short squeeze” which artificially spiked the price.

At this point in time it is too early to tell what will happen with Gill and how much of an impact this GameStop situation will have on the stock market for the coming months or even years.